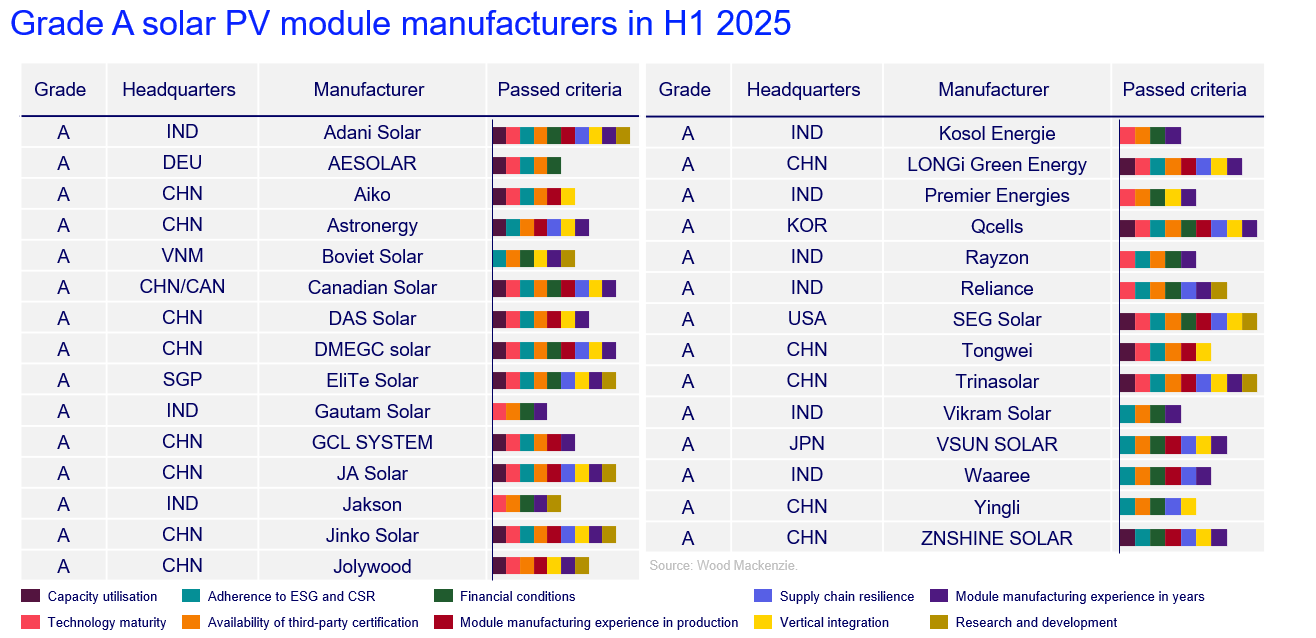

In 2025, the worldwide PV sector began a new phase marked by extensive growth and structural changes. As noted in Wood Mackenzie’s “Global Solar Module Manufacturer Ranking 2025,” the leading ten PV module producers delivered around 500 GW of modules in 2024, nearing an all-time high. This demonstrates that leading manufacturers continue to maintain strong production capacity and supply chain resilience despite an increasingly competitive market.

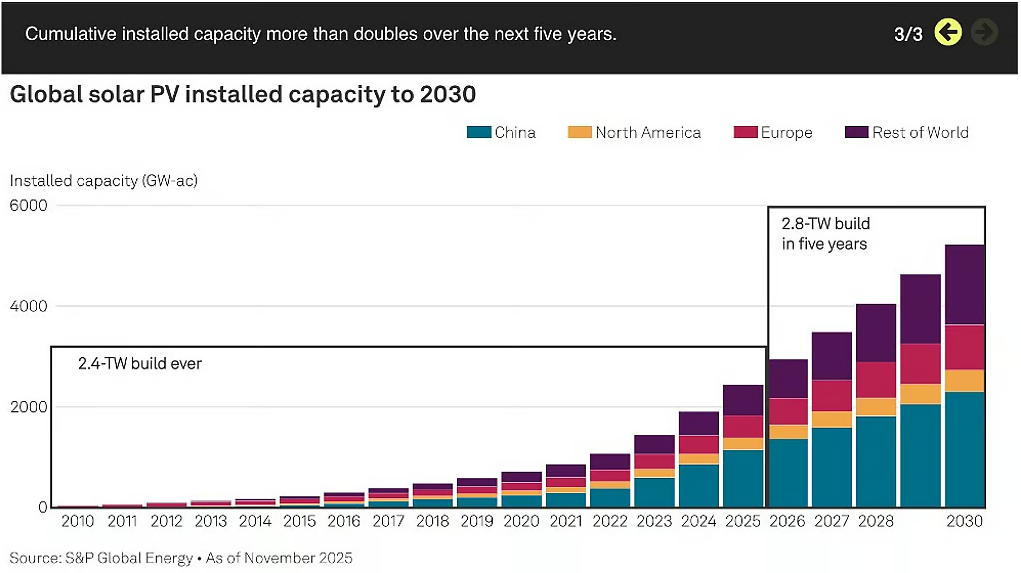

From a broader industry perspective, analysts expect global newly installed PV capacity in 2025 to exceed 450–520 GW. Rapid technological changes are now a key part of the industry. N-type TOPCon and HJT technologies are moving quickly into mass production. This is leading to ongoing improvements in module efficiency and lower costs.

Regionally, although China’s domestic market growth has moderated, it remains the world’s largest PV installation market. Chinese manufacturers continue to dominate upstream and midstream segments such as wafers, cells, and modules. Meanwhile, markets including India, Southeast Asia, and the Americas are experiencing strong growth, supported by policy incentives and localized manufacturing strategies.

In 2025, the global PV industry has grown larger and shown new technology. At the same time, more companies are joining together. A number of vertically integrated, source-level manufacturers have emerged as clear leaders. Building on this foundation, this article identifies and analyzes the Top 10 Photovoltaic Source Factories to Watch in 2026.

Top 10 Global PV Source Manufacturers for 2026

The companies listed are chosen based on their shipment volumes for 2025. They are also evaluated on their manufacturing size, technology strength, and global market impact. We focus on source factories that excel in wafer, cell, and module manufacturing.

1. JinkoSolar

- Main Products: High-efficiency solar modules (N-type TOPCon), wafers, and solar cells

- Strengths: Strong vertical integration, advanced TOPCon mass production, and a globally diversified manufacturing footprint

- Weaknesses: Margin pressure because of intense price competition; exposure to international trade barriers in certain markets.

2. JA Solar

- Main Products: High-efficiency PV modules, solar cells, and wafers

- Strengths: Ranked joint No.1 in Wood Mackenzie’s global shipment rankings; highly efficient factory operations and stable technology roadmap

- Weaknesses: Profitability in certain regions remains under pressure amid fierce global competition

3. Trina Solar

- Main Products: PV modules, solar cells, and integrated smart energy solutions

- Strengths: Deep vertical integration, strong global brand recognition, and diversified technology distribution including TOPCon and HJT

- Weaknesses: Commercialization speed of some advanced technologies slightly lags behind the fastest-moving competitors

4. Canadian Solar

- Main Products: PV modules, energy storage systems, and utility-scale solar solutions

- Strengths: Complete product portfolio with manufacturing bases across China, the United States, and Southeast Asia; strong system-level capabilities

- Weaknesses: Module shipment scale is smaller compared with top-tier Chinese manufacturers

5. DMEGC Solar

- Main Products: Monocrystalline and multicrystalline PV modules

- Strengths: High capacity utilization rates and stable performance in niche market segments

- Weaknesses: Technology upgrade pace is relatively slower than industry leaders

6. Astronergy (CHINT / GCL-related Group)

- Main Products: Solar cells and PV modules

- Strengths: High product reliability and long-term partnerships in global markets

- Weaknesses: Overall market share and production scale still have room for growth

7. Boviet Solar

- Main Products: PV modules and EPC solar solutions

- Strengths: Active manufacturing presence in Southeast Asia, particularly Vietnam, with expanding global capacity

- Weaknesses: Brand recognition and scale are smaller compared with top global manufacturers

8. Risen Energy

- Main Products: N-type TOPCon modules and intelligent PV products

- Strengths: Rapid technology adoption and broad international market coverage

- Weaknesses: Vertical integration depth is relatively limited compared with industry giants

9. Hanwha Qcells

- Main Products: High-efficiency silicon-based modules and customized PV solutions

- Strengths: Strong brand reputation in Europe and North America; focus on high-quality and premium market segments

- Weaknesses: Manufacturing scale is constrained relative to the largest global suppliers

10. Adani Solar

- Main Products: PV modules and solar EPC services

- Strengths: Rapid expansion of manufacturing capacity in India with strong policy support

- Weaknesses: Overall technological maturity lags behind leading Chinese manufacturers

Key Industry Highlights and Challenges in 2025

✅Market Growth

Annual global PV installations are expected to exceed 500 GW, reflecting robust long-term demand

✅Technology Trends

N-type TOPCon technology has become the mainstream choice, significantly improving efficiency and cost performance

✅Competitive Landscape

Leading manufacturers continue to consolidate market share, while facing challenges such as price compression and international trade barriers

Outlook for the Global PV Industry in 2026

Looking ahead to 2026, the global photovoltaic industry is expected to maintain steady growth alongside accelerated technological evolution. Key trends include:

Manufacturing Diversification:

Expansion of localized manufacturing in India, Southeast Asia, and the Americas to reduce supply chain risks

Advanced Technology Commercialization:

HJT and IBC technologies are likely to enter larger-scale commercial deployment

Deeper Supply Chain Integration:

Leading manufacturers will further strengthen control across the entire value chain from polysilicon to modules

PV + Energy Storage Integration:

The convergence of photovoltaic systems with energy storage and intelligent operation will enhance the overall value of solar solutions

The photovoltaic industry is key to the global energy transition. The evolution will continue through innovation, global manufacturing, and sustainable development strategies. Experts expect 2026 to be a critical milestone, featuring both technological breakthroughs and market optimization.

Author’s Commentary

The global photovoltaic industry is entering a decisive stage marked by large-scale manufacturing, rapid technology iteration, and deeper supply chain integration. Based on shipment data and manufacturing strength, the companies highlighted in this article represent the most competitive source-level PV manufacturers worldwide. As the market moves toward higher efficiency and localized production, these leading players will continue to shape global solar supply chains and accelerate the energy transition.

Post time: Feb-10-2026